Common Targets

Don't forget to subscribe to the blog (no charge) to receive educational content!

Identifying When to Use ePayables/Virtual Cards

Now more than ever, organizations have a wide array of payment options from which to choose. How (and whether) ePayables fit into a payment strategy varies by end-user. They tend to be ideal for purchases that are also well-suited for ACH payments and they are meant to complement, not replace, traditional P-Cards. See a related page on regaining a broad perspective of your payment strategy.

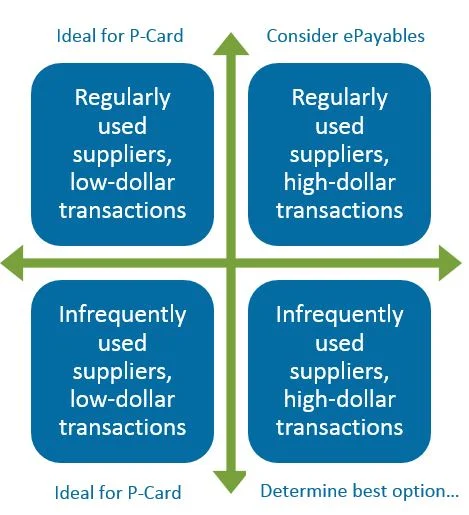

Segmenting Spend: ePayables and P-Cards

The graphic at right segments spend by supplier (infrequently used or regularly used) and transaction value (low-dollar or high-dollar). This is overly simplistic since many purchases fall somewhere in the middle, but it provides a starting point. Each end-user will likely define the criteria differently. Low-dollar transactions could mean $1,000 or less to one organization, but, to another, anything under $5,000.

Do your research by compiling a profile of where your organization is at today. For example, review one year’s worth of payments. An Excel file works well. Sort by dollar amount, lowest to highest. What percentage of your payments are under certain thresholds, such as $1,000, $2,500 and $5,000? It is common for 70–80% to be less than $2,500.

What percentage are check payments? Aim to reduce this statistic.

Example Targets

ePayables: inventory purchases, raw materials, fixed assets, utility bills, and other bills typically directed at accounts payable

P-Cards: office supplies, computer parts, advertising, printing, shipping/courier services, subscriptions, membership dues, event registrations, etc.

Also consider purchase risk and the need for control. The nature of an ePayables process allows you to approve an invoice prior to payment. In contrast, the best practice P-Card process involves a supplier charging the card upon order fulfillment.

Access additional content on ePayables.