Common Rebate Elements

Don't forget to subscribe to the blog (no charge) to receive educational content!

Common elements of rebate incentive schedules

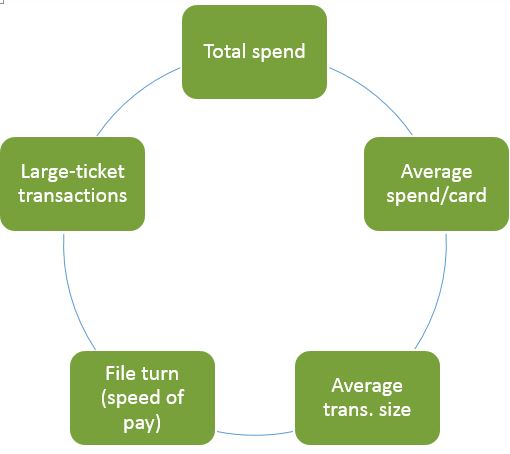

Most issuers propose tiered, multi-faceted rebate incentive schedules, which typically include some or all of the elements shown at right. The incentives could span 100 basis points or more between the lowest and highest tiers. Basis points (bps) are a unit of measure equating to 1/100th of 1%; for example, 100 bps equals 1%, 90 bps equals 0.9%, 80 bps equals 0.8% and so on.

Other rebate elements might include the:

deduction of fraud losses

right of the card issuer to adjust the incentives schedule in response to market/economic forces, which could include government regulation of interchange

See also rebate FAQs. In the example grid below, there would be minimums that an end-user organization must meet before a rebate is possible. The minimums will vary by end-user/issuer contract. An organization might, for example, need to have at least $2M per year in total card spend to be eligible for a rebate. However, even if they meet the total spend minimum, if they take too long to pay the issuer, their file turn might be too high and, per the grid, make them ineligible to earn a rebate.

Example Rebate Incentives Schedule/Grid

About Large-Ticket

Large-ticket transactions are associated with lower interchange rates to entice suppliers to accept card payments for higher transaction amounts. What makes a transaction "large-ticket" depends on the card network's defined criteria (subject to change) for its large-ticket program, such as a certain transaction dollar threshold, the inclusion of Level 3 line-item detail, etc.

Lower interchange rates result in less revenue for issuers. In turn, transactions qualifying as "large-ticket" can mean little to no rebate for end-users. However, expanded card acceptance by suppliers supports greater card usage by end-users and the other benefits of P-Card usage still prevail.