Purchase-to-Pay/Procure-to-Pay Processes

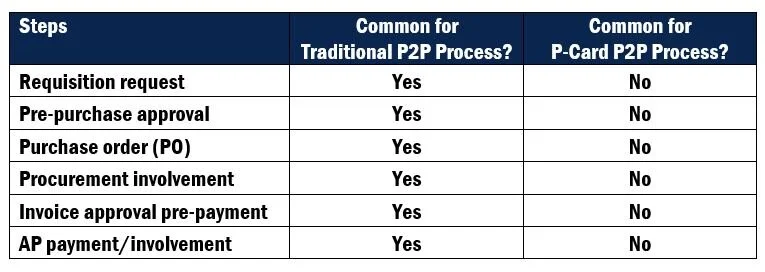

Considering the multiple steps involved with a traditional procure-to-pay (P2P) process (also known as purchase-to-pay process), as shown in the table below, the process cost is often higher than the actual purchase. Such low-dollar purchases, which generally comprise the majority of an organization's payments, are ideal for P-Card.

When implementing a P-Card program, the traditional P2P process should be re-engineered for a new, streamlined process that reaps notable process savings, which tops the list of P-Card benefits. By issuing cards to employees, departments can buy what they need directly from suppliers. This eliminates the need to push everything through the procurement department for a purchase order and/or through accounts payable (AP) for a payment.

Related Resources

Traditional vs. P-Card P2P Processes

Purchase-to-pay processes

The P-Card P2P process requires different controls than what are associated with other P2P processes. For example, transaction review and approval generally occur post-purchase versus pre-purchase. If your organization needs to receive an invoice from a supplier (to approve pre-payment), then consider other payment options, such as ePayables/Virtual Cards, which more closely align with traditional P2P processes.