Overview

Commercial Cards vs. Consumer Cards

In contrast to cards used by consumers, commercial cards are charge cards used in the business world to pay for business expenses. They help diversify an organization’s payment strategy (to reduce the reliance on checks), providing a cost-effective option that can also help improve processes.

Payment card is the broadest term for any card type.

Consumer card is a debit or credit card used by individuals for personal purchases/payments.

Commercial card is the generic, umbrella term for a variety of card types/solutions used for business-to-business (B2B) payments.

Who Uses Commercial Cards?

All types of organizations use commercial cards:

Companies/corporations of various sizes, especially middle market and larger

Government agencies

Higher education institutions

Not-for-profit entities

These card-using organizations are also known as buying organizations, end-users, and end-user organizations. Generally speaking, commercial card programs have “corporate liability” whereby the end-user organization is liable for the transactions and must pay the card issuer in full a minimum of monthly.

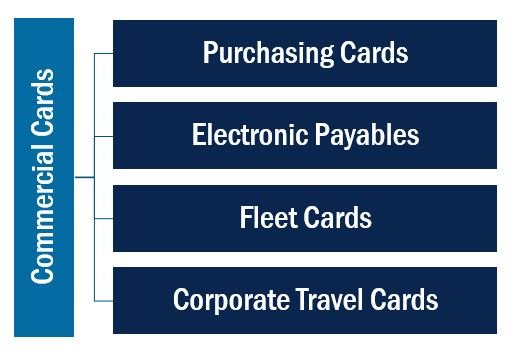

Primary Types of Commercial Cards

“Also Known As”

Purchasing card: P-Card (or p-card), purchase card, pro card, procurement card

Electronic payables: ePayables, electronic accounts payable (EAP)

Fleet card: fuel card, vehicle card

Corporate travel card: corporate card, travel card, T&E (travel and entertainment) card

Some organizations, especially outside the United States, refer to corporate card or even company card to mean any type of card. Historically, physical/plastic cards have been issued to individual employees, but virtual cards pushed to employees’ mobile wallets is a growing trend.

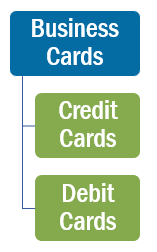

Business Cards vs. Commercial Cards

Business cards, also known as small business cards, are different than commercial cards. They are issued to/used by smaller organizations (as defined by the issuer) for all types of expenses, providing an alternative to a business owner and the employees using their personal cards for business expenses. The business might have both credit cards and debit cards, or just one type. Unlike true commercial card programs, the issuer commonly allows the company to carry a balance on its business credit cards (subject to an interest charge) versus having to pay in full in each month.

Purchasing Cards

Purchasing cards (p-cards) are a type of commercial card used by organizations to pay for business-related goods and services, especially low-value purchases as defined by each end-user organization. The end-user/buying organization must pay its issuer in full each month for the total of all p-card transactions. Learn about p-card benefits to end-users and suppliers. Consider purchasing the short e-book Charge Ahead! An Introduction to Purchasing Cards and Tips for Program Implementation.

P-card Types

Individual cards are typically issued to specific employees. Plastic cards have been the norm, but virtual cards issued directly to employees’ mobile wallets is a growing trend.

Another type is a ghost card/account (sometimes called a lodged card/account) issued to a specific supplier, which charges all of the organization’s purchases to the designated account. An organization might also have ghost accounts reserved for a specific expense type/spend category or internal department. In the latter case, the card account is known as a department card, whereby multiple employees within that department charge goods and services to the card.

With ghost accounts, strong controls are critical to ensure accountability for purchases. The card issuer might restrict dispute rights on cards not issued to a specific individual, so an organization should weigh the pros and cons before pursuing.

All types of p-cards function essentially the same way, with spend limits that refresh each month/cycle and an expiration date that is usually three to five years out. The primary difference among them is who the card/account number is issued to. However, the features and controls related to virtual cards for mobile wallets may differ; for example, the card might be issued for a specific project and expire within a short amount of time (e.g., two weeks).

Examples of Purchases

Every organization determines the

p-card strategy that works best for them—purchase types, spend limits, and suppliers—but common examples of purchases include:

Office supplies

Maintenance, repair, and operations (MRO) goods

Printing and advertising expenses

Shipping/courier expenses

Subscriptions, membership dues, event registrations

Catering for business events

Corporate Travel Cards

As the oldest category of commercial cards, these cards are used to pay for business travel and entertainment (T&E) expenses. An organization can choose from among different types of program liability, but corporate liability is most common.

There are a number of ways that organizations use commercial cards to pay for T&E expenses.

Physical plastic cards might be issued to individual employees.

Virtual cards might be issued to employees’ mobile wallets and/or an organization’s travel management company (TMC).

A Central Travel Account (CTA) associated with one or more specific card account numbers might be given to an organization’s TMC for the purpose of charging employee travel reservations and any related fees.

See also resources related to travel expense management.

Fleet Cards

Fleet cards are a type of commercial card directed at fuel and vehicle maintenance expenses. They offer unique controls and specialized reporting. Typically used at the point of sale for fuel and vehicle maintenance expenses, the cards may be issued different ways: 1) to individual employees, and/or 2) assigned to each vehicle. Learn more about fleet cards.

One Card Programs

With this type of card program, an organization allows a mix of expense categories, such as T&E, fleet, and goods/services on one piece of plastic rather than issuing separate cards (e.g., corporate travel card, fleet card, and purchasing card) for the different categories. “One cards” are also known as multi cards.

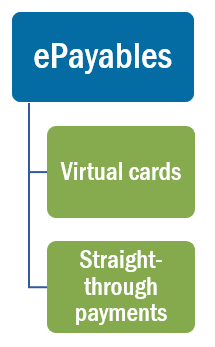

Electronic Accounts Payable (EAP)/ePayables

Electronic payables (ePayables) are a type of commercial card payment solution designed to capture spend that organizations do not typically push through the traditional p-card channel; for example, high-value purchases. Most often, they are part of a traditional purchase-to-pay (P2P) process that includes invoice receipt and approval prior to accounts payable (AP) initiating the payment. As with p-cards, the end-user/buying organization must pay its issuer in full each month.

Virtual cards, also known as pull payments and supplier-initiated payments (SIP), require a supplier to process a charge transaction for the approved amount to a designated account number. These card accounts might also be referred to as ghost cards, but they differ from traditional ghost cards/accounts described above in the p-card section because spend limits do not refresh each month/cycle.

Straight-through payments (STPs), also known as push payments and buyer-initiated payments (BIP), do not involve a supplier processing a charge transaction. Instead, the supplier receives payment directly through its merchant account (related to card acceptance) to its bank account.

Learn more about ePayables/virtual cards.

Other Card Types

Declining Balance Cards

Spend limits do not refresh like p-cards

Specific “shelf life”

Also called controlled value card

Learn more about declining balance cards, including uses by different end-user organizations.

Prepaid Cards

Pre-funded card

Reloadable or non-reloadable

Also called stored value card